As the broader U.S. economy limps into 2021 and stimulus measures work to stave off a double-dip recession, the sentiment in golf remains optimistic, although there are certainly questions about how the industry will fare amid vaccine rollouts and the eventual return to public life. On the whole, golf has been a clear beneficiary of the stay-at-home economy.

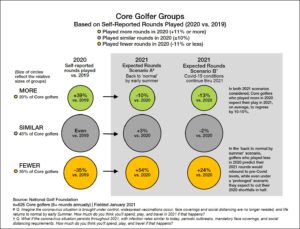

Back in November we discussed how the increases in 2020 play and spend were being fueled, to a significant degree, by a passionate cohort of existing players. We estimated that roughly 20% of the Core golfer population had really upped their engagement, taking full advantage of favorable weather, limited travel and other transient pandemic factors, like working from home. Among non-retirees in this group, 4 out of 5 are still operating on a hybrid or full-time-remote work schedule, compared to just 60% of other Core golfers (8+ rounds annually).

As we look ahead to the next 12 months, it would seem that our ability to match (or at least come close to matching) rounds totals from 2020 would hinge greatly on whether these zealous golfers continued to lean in as they have over the past seven months. Indeed it’s worth rooting for, although our most recent consumer pulse data suggests there will be some ‘regression toward the mean’ for these consumers in 2021.

Last week we asked Core golfers to consider two scenarios – one where widespread vaccinations occurred, face coverings and distancing were no longer needed, and life returned to relative normal by early summer. The other scenario, which may be the more plausible of the two, assumed that the coronavirus situation persisted throughout 2021.

In both scenarios, this ‘zealous’ group expects that their play in 2021 will fall back by 10-15% (their self-reported rounds were up, on average, by almost 40% in 2020). It’s a disappointing but perhaps inevitable reality, that there will be some eventual fallback in engagement among the 2020 fanatics, and yet there’s a bigger force at play here – one that could, and probably will, positively shape the industry in 2021.

Our research indicates 4 to 4.5 million Core golfers reduced their play and spend in 2020 (and they outnumber the ‘zealous group’ by as much as 50%). It’s this group that could really move the needle in 2021. In the ‘back to normal by summer’ scenario, these golfers predict their play would rebound to pre-Covid levels, while even under a ‘prolonged’ scenario they expect to cut their 2020 shortfalls in half, which would still provide a significant boost to rounds this year.

There will be other factors at play – like the weather, which couldn’t have been much better in 2020, some rebounding in travel golf and event golf (leagues, outings, etc.), or the inflow of new and returning players, and how they’ll respond in 2021. But the important takeaway here is that U.S. golf rounds were up significantly in 2020 despite the fact that a large swath of the Core golfer population (roughly a third of them, myself included) was actually pulling us in the opposite direction. So the bigger question is not whether the zealous golfers will keep charging this year, but to what extent the ‘underperformers’ will bounce back. Certainly our data gives hope.

Stay safe out there.

David

David Lorentz

Chief Research Officer

National Golf Foundation

[email protected]

501 N Hwy A1A, Jupiter FL 33477

www.ngf.org